Let’s just get one thing out of the way:

I’m a weird guy.

That’s what Forbes and Yahoo Finance! really meant when they called me “interesting” and “eccentric.”

But I totally own it.

The fact is – I don’t think like most people.

I’m unconventional. And I don’t like to follow the herd.

I’ve found this to be an incredible asset when it comes to making money.

Most entrepreneurs I’ve met are incredibly weird. Your brain has to be wired differently to climb to the top 1% in your field.

The same holds true with investing.

When it comes to investing, conventional thinkers are losers.

I’m sorry if that offends you.

I promise I’m not trying to be rude.

I’m just talking basic stats. In the financial industry, there’s an army of liars, losers and thieves that try to keep you enslaved to conventional thought.

- On average the S&P 500 goes up about 10% every year…

- Most money managers underperform the stock market averages…

- And most individual investors do even worse without professional help

And yet our entire, multi-trillion-dollar financial industry revolves around this exact sort of weak-minded thinking.

Personally, I have zero interest in trying to make 10% every year.

And I could care less about the opinions of people who try – and fail – to do even that.

When I’m investing my money, I’m ONLY looking for opportunities that I think can grow my money 1,000%.

Whether it takes a year, or 10 years, I don’t really care. I have to see 1,000% upside before I’ll invest a dime.

That’s why I make the radical predictions that I make.

- Like predicting Facebook would become the world’s first $100 billion company in 2007. CNBC laughed at me when I said this. In 2012 Facebook went public at a $104 billion valuation – the first tech IPO in history to achieve this. And it’s up 1,000% since.

- In 2011 I predicted Apple would become the world’s first $1 trillion company. Later I doubled down and said it would be the first to hit $2 trillion. Today it’s $3 trillion and up about 1,000% since I made my first prediction.

- In 2013 I told CNBC I was bullish on Bitcoin. That year, as part of a marketing stunt to sell my book Choose Yourself (which later became an international bestseller), I created a website where Bitcoin was the only way you could buy it. I called Bitcoin the “Choose Yourself” currency. Bitcoin is up 50,000% since.

Right now, I’m making another big prediction on a tiny sub-niche of investments that I like to call “SUPERSTOCKS.”

I believe they will outperform the S&P 500 for the next 5 years at least.

Starting next week, I believe we’re about to see a historically proven setup that has the potential to return 1,000% over the next year.

1,000% Winners Aren’t New to Me

The situation we have right now reminds me a little bit of what I saw back in 2008.

In November of that year, I published a book called “The Forever Portfolio.” It contained an extensive list of stocks that I recommended buying and holding, well, forever. Jim Cramer recommended it and Stephen Dubmer, the coauthor of Freakonomics, wrote the foreword.

When this book dropped, it was totally at odds with the conventional wisdom of the time.

The U.S. financial crisis had just reached a fever pitch. The stock market was down about 50%. Practically everybody was bearish.

But where others saw chaos, I saw immense opportunity.

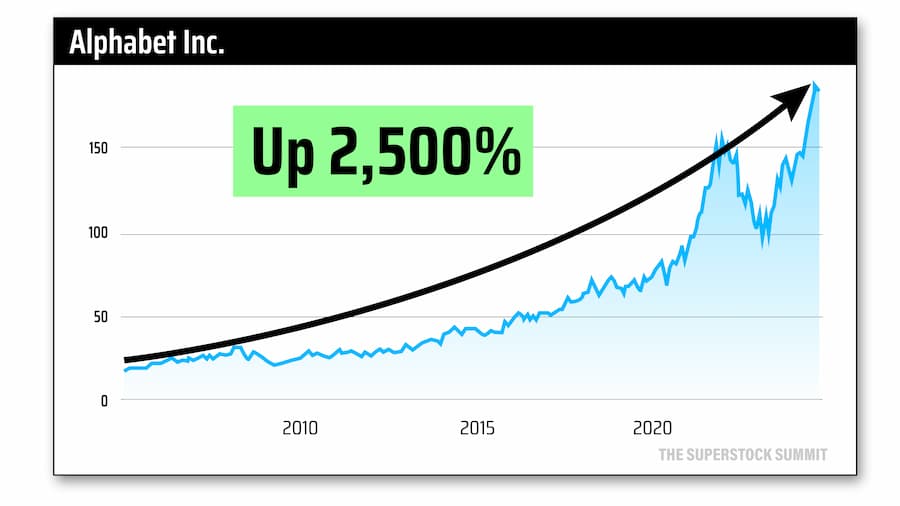

One of my favorite ideas at the time was Google (GOOGL).

Here’s what I wrote:

“Google dominates search, video, and online advertising, and eventually it will dominate offline advertising. I don’t care what the P/E ratio is. I don’t even care what the actual percentages are that it dominates in each area. Every year for the next fifty years, it will probably go up in each category.”

At the time GOOGL was down more than 50% from its all-time high.

This, to me, looked like an obvious chance to buy the predominant market leader, in a massive ongoing trend, for cheap.

And I was right.

Google’s stock would never get any cheaper than it was in late 2008. Since then, it’s up 2,500%.

But most of the other stocks I recommended in the book were TINY and a lot more obscure.

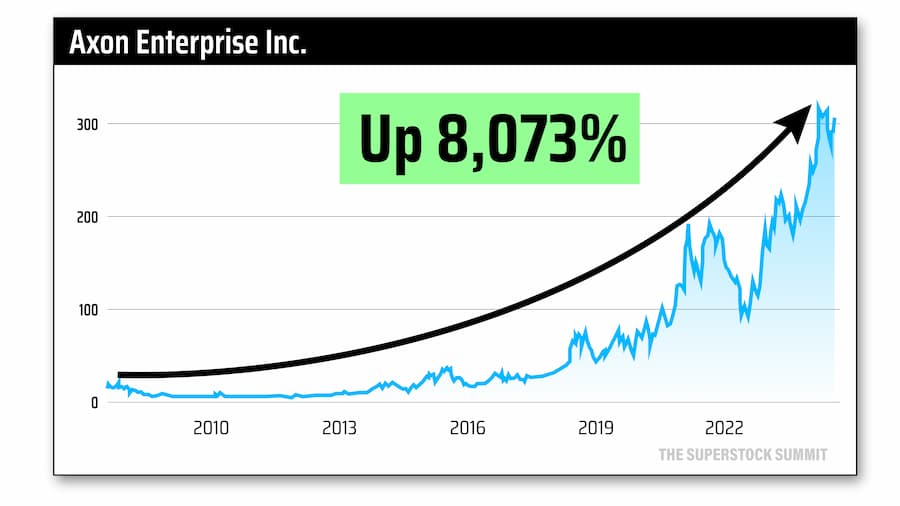

Have you ever heard of Axon Enterprises (AXON)? Probably not. But you’ve probably heard of the “Taser.” Yes, that Taser – the stun gun you’ve seen in a million Hollywood movies (maybe you own one yourself).

The stock was worth a little more than $3 when I wrote about it in 2008.

Today, it’s a $300 stock.

It’s up 8,073%.

Once again, this was an obvious opportunity to invest in a market leader – a dominant force in its field – at a nice discount.

Here’s another one – ResMed (RMD). It creates medical equipment designed to treat sleep apnea and other respiratory conditions.

The company had carved out a dominant niche in a market with ongoing demand.

Take a look. The stock is up another 1,000% since I wrote about it.

You’re probably starting to notice a pattern. You want to buy off-radar, industry leaders when they’re cheap.

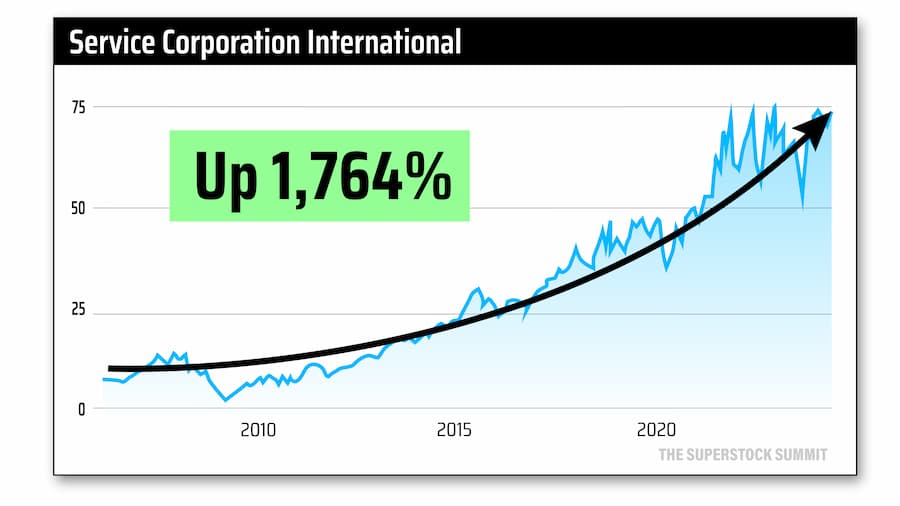

It was the same case with Service Corp. International (SCI). The company owned 1,500 funeral homes and 400 cemeteries. Talk about a market that’s not going away.

This was a $4 stock in 2008. Today, shares are worth about $75.

That’s 1,764%!

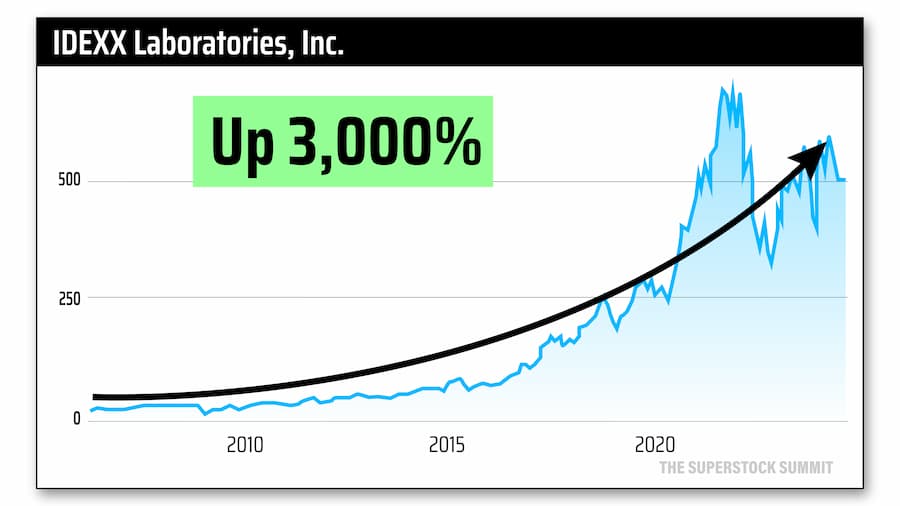

Here’s one more that’s a little less morbid. Idexx Laboratories (IDXX) makes products to text water for biological contaminants. It also designs tests for the veterinary, livestock, poultry and dairy markets.

The stock was worth about $15 per share in 2008. It’s worth over $450 today. That’s 3,000%.

My point in all this is that while most investors were freaking out and acting like the sky was falling, I was bargain hunting. And I found multiple stocks that went on to become huge 10-baggers.

We don’t have opportunities like this very often…

This Is One of Those Times

Look…

While the mainstream media and Wall Street are going gaga over the weekend’s news about Biden…

I’m recommending ALL of my readers pay attention to a 50-year market setup that NO ONE is covering right now.

This is the perfect storm (very similar to the “Forever Stocks” above.)

And there’s a very reliable catalyst that tells me RIGHT NOW is the time to buy. I’m going to tell you more about this catalyst tomorrow.

According to my research, this catalyst has a reliable, proven track record of telling you exactly when these “SUPERSTOCKS” are about ready to break out.

I’ll tell you more about this tomorrow – and I why I don’t think it will take 10 years to see several stocks potentially go up 1,000%.

In fact, the last time this setup occurred, I found multiple stocks that did it in one year…

>>>Part 2 tomorrow – check back on July 23 at 2pm ET right here on the website.<<<

And mark your calendar for THE SUPERSTOCK SUMMIT this Thursday at 8 pm Eastern. See you then.

James Altucher